Atlanta Market Report | Q2 - 2025

- Gregg Metcalf

- Aug 21, 2025

- 8 min read

Updated: Aug 22, 2025

01- Atlanta Insight

• Record leasing activity from last year drove positive absorption for the first time in 10 quarters.

• Supply-side shifts are playing a more significant role in shaping market fundamentals, as Atlanta office inventory recorded its largest reduction on record and new construction remained limited.

• The Atlanta office market is experiencing greater in-person office attendance, ranking third nationally, which could shape future leasing and space utilization trends.

The Atlanta office market demonstrated a shift in several key fundamentals in Q2 2025. Total absorption was positive 126k s.f., a notable change from the negative absorption seen the previous three years. The five largest move-ins were all in either the Midtown or Central Perimeter submarkets, one of which was a new-to-market entry and the rest of which were relocations within Atlanta. The four relocations involved a combination of tenants increasing and contracting their footprints, with an average growth of 35% underscoring the varied approaches occupiers are taking to address evolving workspace requirements.

Office inventory decreased by 2.9 million s.f. in Q2 2025, marking the largest quarterly reduction recorded in the Atlanta market and representing more than half of the total inventory decline observed in recent years. The removals from inventory, almost all of which are demolitions and ongoing redevelopments, are a contributing factor to the market's decline in vacancy, which dipped 110 basis points quarter-over-quarter.

Trophy/Class A net effective rents were up from this time last year and at their highest point since pre-2020 due to the marginally declining concession packages observed in the first half of 2025. As availability tightens in existing top-quality assets while the market faces new supply constraints, concession packages may continue to level off.

Atlanta ranked third nationally for office attendance recovery as of May 2025, trailing only New York and Miami. This highlights the market’s greater degree of in-person office utilization compared to most other major U.S. cities, and should influence leasing decisions.

Data Source: JLL Research

02- Deals and Development Totals & Class A Statistics

Totals & Class B Statistics

03- Quarterly Statistics

Largest Leases 2025 YTD

Development Activity Q2 2025

Historical Atlanta Office Data

04- Atlanta Office Submarket Map

05- Submarket Insights

Midtown

Midtown Relocations reinforce Midtown’s position as a premier office hub in Atlanta

• Midtown was the only urban submarket to incur positive absorption in Q2, marking the third consecutive quarter of net occupancy gains and its strongest performance in nearly three years.

• Midtown captured three of Atlanta's four largest move-ins in Q2, all representing relocations from other submarkets, which propelled positive absorption of 367k s.f. The largest move-in was Piedmont

Healthcare, who relocated from the Northwest submarket and contracted by 29% but still took occupancy of a significant 181k s.f. space at Atlantic Station. These moves underscore the submarket’s

enduring appeal, attracting companies across Atlanta who choose

to relocate their offices.

• Availability across Trophy assets in Midtown (which represent one-third of the submarket’s inventory) declined by 80 basis points QoQ to 22.5% due to over 60k s.f. of leasing activity in Q2. This tightening

availability of premium space may accelerate tenant decision making regarding lease commitments in the near-term.

• The ongoing supply constraints are expected to have a significant impact on Midtown as the submarket is typically characterized by new development (Midtown comprised 50% of new deliveries across Atlanta in the last decade). No new office supply is expected after 1072 W Peachtree delivers (224k s.f.)

|  |  |

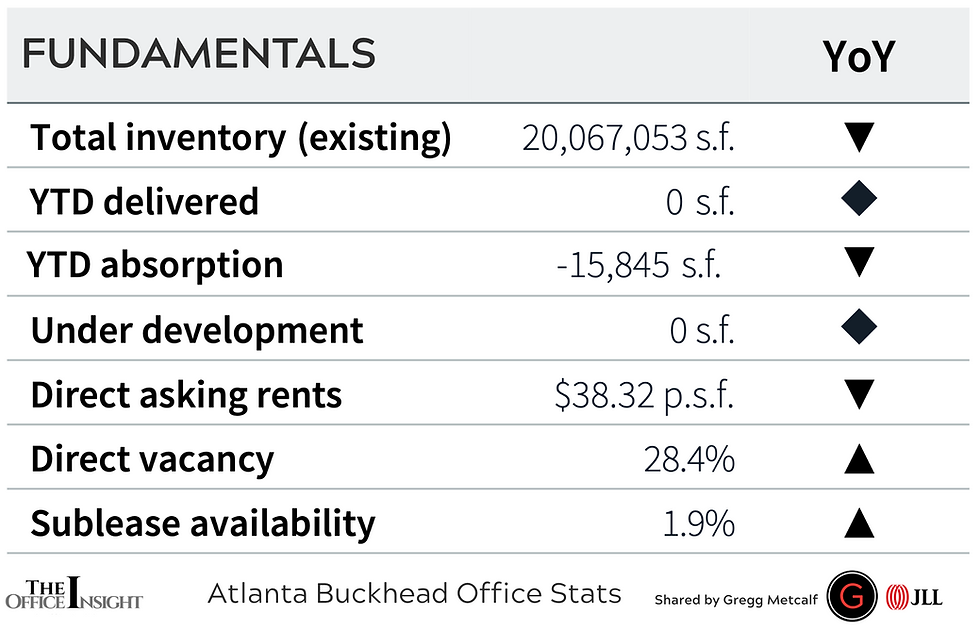

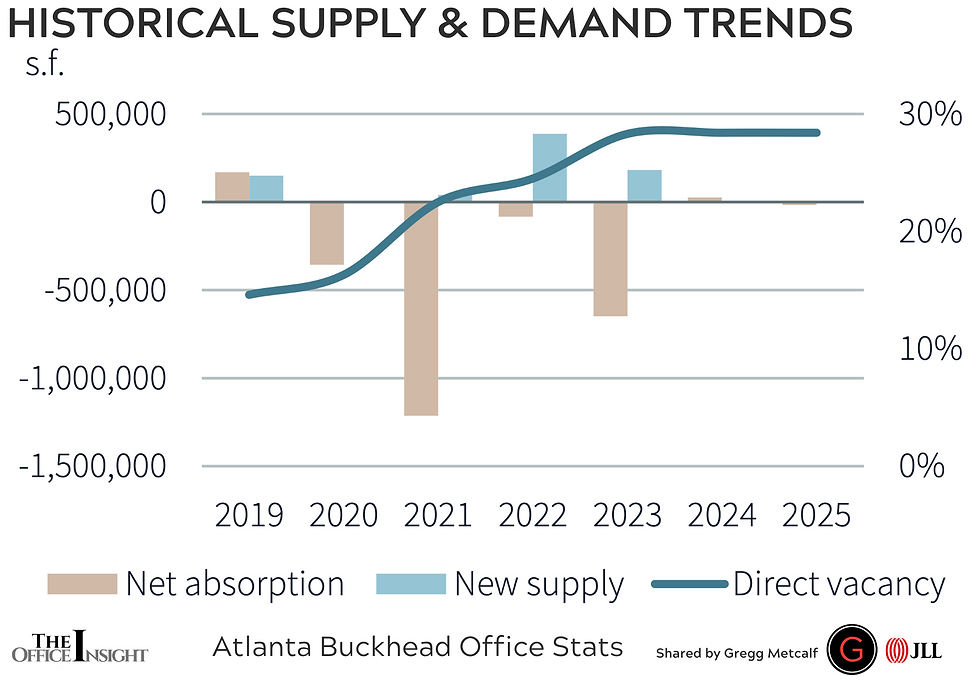

Buckhead

Buckhead

Renewals comprised over 50% of Q2 leasing activity, which is significantly above the market average

• After occupancy gains in the first quarter, YTD absorption turned negative as move-outs outweighed move-ins in the second quarter. Aon was the largest move-out due to their relocation to a sublease

in the Central Perimeter submarket.

• Renewals made up 52% of Buckhead leasing activity in Q2, which was the greatest share in six quarters, indicating tenant retention in the submarket. The two largest deals signed in Buckhead in Q2

were both renewals – AT&T at Lenox Park (73k s.f.) and RESICAP at 3630 Peachtree (28k s.f.).

• Availability is tightening across Trophy assets in Buckhead as only one block for more than 50k s.f. is available, and it is 2nd Generation space. This means quality Class A assets may benefit from spillover

demand in the near-term and be able to achieve asking rent growth.

• Looking ahead, Buckhead is expected to remain a stable submarket as it continues to attract many users from the Finance and Real Estate industries. Additionally, several recent retail openings have contributed to growing the submarket’s appeal and help position it as a prime destination for corporate users.

|  |  |

Downtown

Downtown

Quarterly absorption was negative but indicates year-over-year improvement

• Negative absorption in Downtown intensified during the second quarter (-119k s.f.) , but is a 64% improvement from this time last year. This was driven by no move-in being greater than 7k s.f. and

HNTB vacating their 39k s.f. space at 191 Peachtree to relocate to one of the newest assets in the Midtown submarket.

• Q2 leasing volume amounted to over five times that recorded in Q1 and was entirely comprised in Class A assets, while being a mix of renewals and new leases. Many tenants from the government industry continue to favor the Downtown submarket, as evidenced by the largest deal signed in Q2: U.S. General Services Administration (GSA) took 44k s.f. at 250 Williams and will be relocating their office from 230 Peachtree nearby.

• As Downtown prepares to welcome the world for events like the 2026 FIFA World Cup and 2028 Super Bowl, development across all real estate sectors, including office, should accelerate. $11 billion in

catalytic investments is planned and the submarket is on its way to creating a more dynamic, livable urban center while leveraging its unique combination of assets—authentic historic architecture, unmatched connectivity and vibrant cultural attractions.

|  |  |

Central Peremeter

Central Peremeter

The submarket landed the most leasing activity across Atlanta in Q2, driven by new-to-market entry: TriNet

• Newell Brands nearly doubled their footprint after relocating to 182k s.f. at Concourse Corporate Center Five. Their prior Class B space – also in Central Perimeter - was sold in an owner-user sale to

another Fortune 500 company, Asbury Automotive, and will contribute to occupancy gains in H2 2025. This is a nod to both the strong presence of Fortune 500 companies in the submarket as well as the growing activity in owner-user sales.

• Q2 saw the most notable deal in the first half of 2025 – TriNet, a California-based HR solutions company, is establishing a 145k s.f. hub in the brand-new mixed-use development High Street. They

plan to create 750 new jobs at this location over the next five years, a testament to Atlanta's thriving business ecosystem.

• Embassy Row buildings 100 and 300 were demolished in Q2 2025 to make way for approximately 340 and 360 residential units, respectively. Building 100 has been vacant since 2023 and Building 300’s tenant move-outs contributed 60k s.f. to Class B negative absorption.

• Central Perimeter offers tenants high-quality office space in a prime suburban location with an urban feel. Recent mixed-use and retail developments have enhanced the area's appeal, making it

|  |  |

Northwest

Northwest

The Northwest maintains its position with the lowest vacancy rate across Atlanta’s major submarkets

• The Northwest posted overall positive absorption for Q2 2025, recording 41k s.f. of net occupancy gains despite Class A losses. One large Class B move-in buoyed absorption and helped outweigh the

largest contributor to Class A losses – Piedmont Healthcare vacating 253k s.f. and relocating to Midtown.

• Despite Class A occupancy losses, the Northwest continues to boast the lowest overall vacancy rate, as well as lowest Class A vacancy rate among all major submarkets – a testament to the area's

enduring appeal to corporate tenants.

• Sublease activity was particularly robust in Q2, with the submarket accounting for 43% of subleases signed across the Atlanta market, by count. This contributed to a 110 basis point decline in sublease

availability QoQ, which now stands at just 3.6% of inventory – a level not seen since Q3 2021 before the major influx of sublease space began. This reduction in sublease availability signals growing

market stability and tenant confidence in the submarket.

• As market fundamentals continue to strengthen, the Northwest appears well-positioned to maintain its competitive advantage and capture emerging opportunities in Atlanta's evolving commercial

landscape.

|  |  |

North Fulton

North Fulton

Under development mixed-use project, Medley, lands the submarket’s largest lease in the first half of 2025

• Three office properties, amounting to 385k s.f., in the North Fultonsubmarket were removed from inventory in Q2. These buildings were 90% vacant, on average, which contributed to a 60 basis point

vacancy decline QoQ, despite negative net absorption.

• Though overall absorption was negative, sublease absorption was positive, driven by last quarter’s largest deal taking occupancy (CRH Americas Materials’ 52k s.f. sublease at Stonebridge II).

• Leasing activity in the first half of this year was up 8.5% compared to the same period in 2024, with 421k s.f. of deals signed, 76% of which were new leases. While a record large new deal was signed in

Q2, activity has been increasing in deals under 5k s.f., with leasing volumes in this segment up 40.0% YoY.

• Boehringer Ingelheim signed the largest deal in the submarket this year, which notably was the largest new deal signed in the last eight quarters. They will be moving their HQ to the 43-acre under

renovation Medley project in Johns Creek, taking 74k s.f. at a former State Farm building.

• North Fulton is home to an array of large office parks with attractive surroundings and lively retail nodes. Its suburban location will continue to attract certain corporate users.

|  |  |

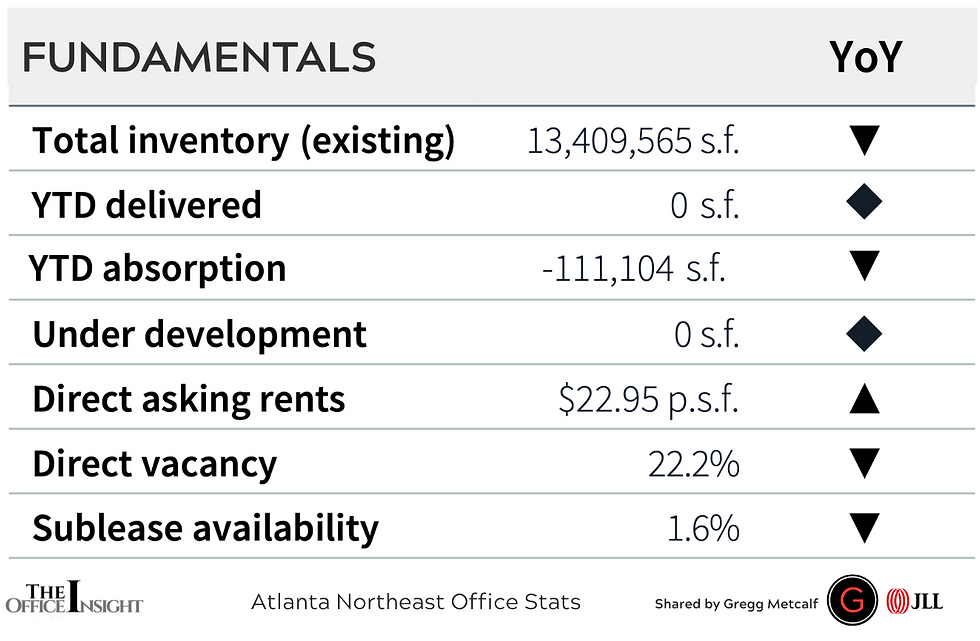

North East

North East

Second consecutive quarter of positive absorption driven by strong Class A performance

• The Northeast was one of three major submarkets to record positive absorption in the second quarter, which was driven by an accumulation of Class A occupancy gains all smaller than 15k s.f. Additionally, only one Class A move-out was greater than 5k s.f., which helped keep quarterly Class A absorption figures above 70k s.f. for the first time in three years.

• The addition of a 25k s.f. sublease from technology solutions firm Davies at Summit at Peachtree Parkway contributed to a 40 basis point rise in sublease availability QoQ. Sublease availability poses

little to no threat to landlords in the Northeast as even with the slight increase, it remains with the lowest sublease availability among all submarkets representing just 1.6% of inventory.

• The 1.5 million s.f. Scientific Atlanta Complex was removed from inventory as its redevelopment into the Sugarloaf Logistics Hub, a 6-building and 2.3 million s.f. industrial park, commenced.

• The Northeast sits with a surplus of commodity office product, but it continues to attract an array of global and national businesses. It will continue to dip into its strengths as a prime Atlanta corporate

office location that offers a well-educated workforce, excellent schools, and desirable residential areas.

|  |  |

How to Stay Ahead

Conduct a Needs Analysis to align your real estate strategy with your business objectives.

Secure and Optimize Office Location(s), Space(s), and Lease(s).

Maximize Profitability, Recruitment, and Retention

Many companies lose millions of dollars due to lack of employee engagement, loss of top talent, and inefficient or unneeded office space.

Working with Gregg Metcalf, clients gain the insights, the analysis, and the plan to obtain the lease and office space that retains the best employees, attracts top talent, and maximizes productivity as well as profitability.

To Contact Gregg Metcalf:

email: gregg.metcalf@jll.com

mobile: 404.661.9284

Comments